If you’re an entrepreneur, you know that recognizing bank cards is a crucial part of your small business, specially seeing that on-line acquisitions are quickly being the standard. But, what will happen when you’re not capable to find a merchant account company that can work with your company? Here is where higher-risk vendor accounts come into perform. Within this article, we are going to be talking about what great-chance vendor profiles are and how they may reward your organization.

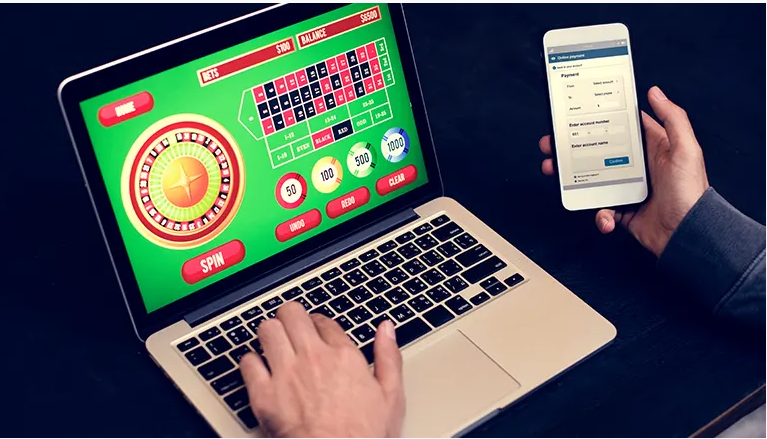

For starters, let’s discuss what substantial-risk merchant profiles are. Higher-risk merchant credit accounts are specifically designed for companies that are considered high-chance as a result of form of products they offer. These firms include the ones that belong to groups for example wagering, adult high risk merchant accounts leisure, and CBD oils income. As a result of character of those goods and services, classic processing account providers are reluctant to work with them, for this reason the demand for higher-chance merchant accounts.

With higher-chance merchant balances, company owners can continue to agree to credit card repayments from their customers, nevertheless the costs and costs linked to these accounts may differ from standard vendor profiles. Because of the higher risk engaged, fees might be significantly increased, and this can placed a strain on a business’s earnings. However, there are particular good things about using a high-danger merchant account. For starters, it includes a higher amount of fraud safety. With high-threat enterprises, there is certainly always the danger of fraudulence or chargebacks. Great-risk vendor accounts generally offer more sturdy fraudulence safety to minimize the risk of these kinds of incidences.

Additionally, higher-threat service provider accounts offer higher overall flexibility. Traditional merchant card account service providers often need strict commitments and extended endorsement intervals. Having a great-risk processing account, the acceptance method is quicker, and contract phrases could be much more versatile. Moreover, firms that run globally may benefit from higher-risk service provider balances as they are able cater to international transactions.

Thirdly, high-risk merchant profiles provide greater steadiness. With conventional vendor credit accounts, companies operate the chance of possessing their profiles terminated unexpectedly as a result of extreme chargebacks or suspicious process. As opposed, substantial-threat merchant account suppliers are more loaded to handle great-risk dealings and give increased steadiness in connection with this.

In spite of these positive aspects, it’s crucial to remember that high-risk vendor accounts aren’t a 1-dimensions-suits-all option. Fees and charges related to these profiles might be significantly increased, and companies must weigh up the advantages and disadvantages before making a decision. As a business person, it’s important to do business with a professional higher-chance merchant account provider that gives clear fees and ideal customer service.

Simply speaking:

In In short, higher-chance vendor accounts are a crucial aspect of conducting business for people who operate in high-risk sectors. Even though the costs and prices connected with these profiles may be beyond their classic counterparts, the benefits can be considerable. It’s vital to use a higher-chance processing account supplier that offers transparent costs and excellent customer satisfaction so that the stability and growth and development of your business. Using these elements in your mind, navigating the high waters of higher-danger service provider balances can be done more comfortable.