Making an investment in shares is probably the wisest fiscal decisions you could ever make. In today’s globalized entire world, there are loads of expense prospects accessible around us. One of the more preferred expenditure spots is definitely the US stock market, which is regarded as the most significant and most strong on earth. However, for Invest United States (Invertir Estados Unidos) newbie buyers, buying gives in the states can seem challenging. In this post, we are going to explore some basic techniques that will assist you understand how to purchase United States Of America Shares.

1. Look for a trustworthy dealer: The first step to purchasing reveals in the states is to find a reliable brokerage. It is an professional that may assist in the purchase of gives for you personally. There are loads of agents you can purchase, but choosing the right fit for you can be a lttle bit difficult. Probably the most well-liked labels incorporate E-Industry, Charles Schwab, TD Ameritrade, and Fidelity. These online agents supply competing service fees, expert support service, and a wide range of purchase resources to assist you get gives.

2. Available a brokerage service accounts: Upon having picked an agent that best fits your requirements, you need to open a brokerage firm bank account. The bank account will work as a gateway for buying and selling reveals on the web. To open an account, you need to complete a signing up kind, offer your personal info, and upload a sound Identification. Some agents may expect you to satisfy some minimum down payment needs, and some may give you percentage-free of charge investing.

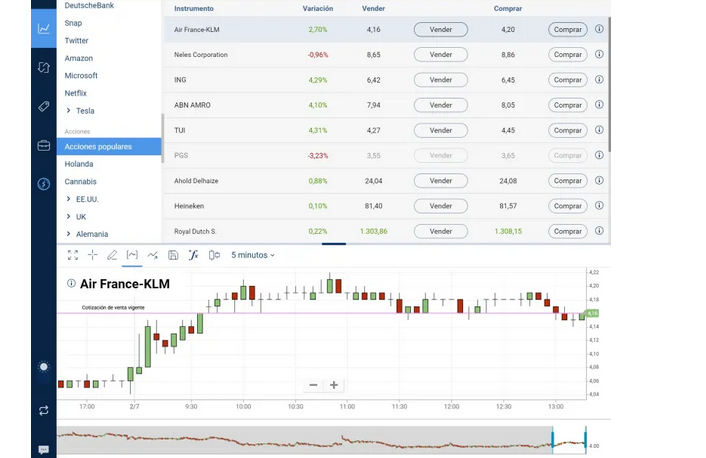

3. Select the stocks to get: Together with your brokerage firm bank account put in place, you can now begin looking for stocks to buy. It is recommended to research the root assets and look their ancient functionality just before shelling out. Popular websites such as Yahoo Financial and Yahoo Financing are wonderful helpful information for carry evaluation. Also you can read financial information, follow stock market developments, and think about the expenditure goals for your personal investment profile. Being a newbie, it is wise to invest in organizations with a good track document, such as The apple company, Amazon, Microsoft, and Google.

4. Position your acquire order: Upon having chosen the stocks to buy, it is time for you to position your buy requests. Your brokerage firm accounts may have an investing system that will allow you to location purchases for your personal preferred stock. Your buy will specify the quantity of offers you need to get and also the value you are able to spend. You should remember that when you spot a acquire order, the buying price of the stock may go up and down, along with your agent may have to load an order in line with the present market price. You need to consider utilizing restriction purchases that allow you to specify a highest cost you are likely to pay for a carry.

5. Monitor your ventures: Eventually, it is very important keep track of your assets frequently. This simply means keeping an eye on the overall performance of your respective share collection and generating needed modifications when necessary. You should use the investing system given by your brokerage to monitor the price of your investments, review marketplace styles, and browse business financial assertions. It is also essential to keep watch over world-wide financial media which may influence your portfolio’s overall performance.

Conclusion: Acquiring offers in the United States might be a fantastic expenditure opportunity, but it calls for some fundamental expertise and investigation. By locating a reputable brokerage, starting a brokerage bank account, choosing the right stocks and shares, positioning your get order, and checking your investments, you may discover investment possibilities that might otherwise be out of reach. Keep in mind that investing in stocks and shares includes hazards, and you need to only commit cash that you will be prepared to drop. With persistence, self-discipline, plus a long-term view, you may make the most out of your purchase profile and get your financial objectives.