Have you ever considered Cfd trading but have little understanding of what it is? Cfd trading or Contracts for Difference trading is a form of financial derivatives trading that enables investors to speculate on asset prices without physically owning the assets themselves. Cfd trading is gaining more popularity amongst traders, especially those looking to diversify their portfolios. As an investor, you stand to gain significant profits if you are able to put your money in the right place, at the right time, with the right broker. In this blog post, we will explore the world of Cfd trading and how it offers immense profit potential to investors.

Understanding the basics of Cfd trading

cfd trading is an innovative way of trading in financial markets that allows traders to speculate on price movements in a broad range of assets, including stocks, currencies, commodities, and indices. When a trader buys a CFD, they are essentially betting on whether the price of an asset will rise or fall. If the price goes up, the trader makes a profit, but if it goes down, the trader will incur a loss. One of the most significant advantages of Cfd trading is that it allows traders to trade on margin. Margin trading means that traders can open much larger positions than their account equity, thereby increasing their profit potential.

Advantages of Cfd trading

One of the main advantages of Cfd trading is a flexible trading experience. CFDs can be traded across many asset classes and sectors, which provides traders with diversified trading opportunities. Furthermore, Cfd trading provides traders with an efficient way to go short on the markets. This means that traders can profit from falling prices, as well as rising prices. Besides, Cfd trading provides traders with the capacity to trade on margin. This allows traders to increase their buying power and potentially enhance their profits.

Cfd trading risks

While Cfd trading offers tremendous profit potential to investors, it also comes with risks. One of the main risks in Cfd trading is that leveraged trading can wipe out an investor’s account if they make a wrong bet. Therefore, it is critical to have a good understanding of how CFDs work and the risk management tools available. It is essential to educate oneself on risk management strategies, such as stop losses, to limit potential losses.

Factors that affect Cfd trading profit potential

Several factors influence Cfd trading profit potential, including market volatility, leverage, financial leverage, risk management, and trading strategies. Traders who have a good understanding of these factors are more likely to make informed decisions and improve their chances of profiting from Cfd trading. It is essential to have a solid understanding of financial instruments, such as stop losses and limits, to manage and reduce risks.

Choosing the right Cfd trading broker

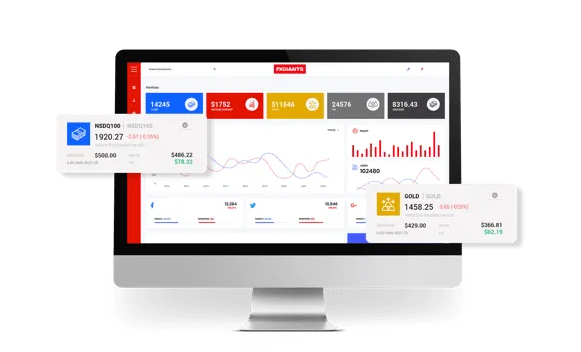

When starting on your Cfd trading journey, it is crucial to choose the right Cfd trading broker. Factors to consider when choosing a Cfd trading broker include the broker’s reputation, regulation, trading platforms, deposit, and withdrawal methods, and customer support. Choosing a reputable broker is essential to minimize the risk of fraud or mismanagement of funds. A good Cfd trading platform should also provide detailed Charting tools, Educational resources, and trading signals.

short:

Cfd trading offers immense profit potential to experienced and novice investors alike. However, before you start trading CFDs, you should take the time to understand the basics of financial markets and have a sound trading plan. Remember, Cfd trading involves risks, and as such, traders need to have risk management strategies in place. Finding the right Cfd trading broker is crucial to leverage your trading, so consider the reputation of the broker, the regulation, trading platforms, deposit, and withdrawal methods, and customer support. With a combination of this knowledge and research, coupled with the right Cfd trading broker, you’re well on your way towards profiting from Cfd trading.